Top 10 Main Challenges of Crypto Adoption - Exploring the Barriers to Widespread Acceptance

Salomon Kisters

Dec 20, 2022This post may contain affiliate links. If you use these links to buy something we may earn a commission. Thanks!

In the last few years, cryptocurrency and blockchain technology have grown more popular and are starting to enter the mainstream. Despite the hype around these technologies, the wide adoption of crypto investments and digital currency in daily life still faces many challenges.

In this blog article, we examine ten of the most significant obstacles to the widespread acceptance of cryptocurrencies. Although education is crucial for the spread of cryptocurrency, new solutions will be required for it to reach its full potential.

From volatility concerns to poor processing speeds and beyond, addressing or eliminating these hurdles might be a particularly worthwhile endeavor for both individual and institutional investors seeking significant financial returns from entering into the digital currency space.

Willing to step in? Let’s explore some challenging problems to widespread crypto acceptance and adoption together!

Why is Crypto Acceptance Still Challenging After All These Years?

Although the blockchain and cryptocurrencies have been around for over a decade now, their adoption has been relatively slow due to a myriad of challenges.

Despite the potential of cryptocurrencies to revolutionize the world by offering a secure, fast, and global payment system, there is still much work to be done before mass adoption becomes a reality.

Here are the ten most significant cryptocurrency adoption challenges that one should know about before venturing into the crypto space!

1. Lack of Understanding of What Cryptocurrency is and How it Works

A general lack of awareness about what cryptocurrency is and how it functions is one of the greatest obstacles to widespread crypto adoption. There is a need for greater education on the subject so that people realize what they are getting themselves into when they invest in digital currency.

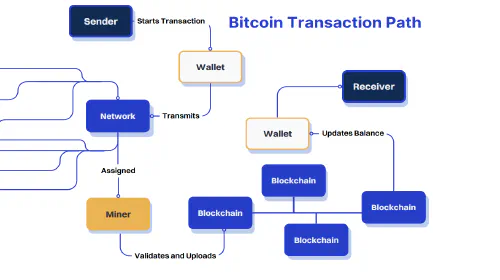

The blockchain technology that powers many of the most famous cryptocurrencies today is complex and difficult for many individuals to understand. It is essential to provide clear and concise explanations of how cryptocurrency operates, its benefits over traditional financial systems, and its innovative applications.

Providing access to tools like online courses and tutorials will help enhance awareness and encourage more people to participate in crypto.

2. Volatility

Due to the extraordinary volatility of most cryptocurrencies, even the most popular ones like Bitcoin and Ethereum, some investors may be reluctant to invest. The volatility of the value of a particular cryptocurrency makes it difficult for investors to forecast their continued profitability in the future.

Before investing, it is imperative that investors understand the risks and dangers connected with the fluctuation in the value of digital currencies.

In addition, cryptocurrency exchanges should provide investors with educational materials and user-friendly guides to help them analyze the market and make educated choices.

3. Lack of Regulatory Frameworks

The relatively unregulated status of cryptocurrencies is one of the primary hurdles to their widespread adoption. This implies that no regulations are limiting their use, which may make some individuals hesitant to invest in them.

In addition, it is even more difficult for exchanges to protect their users from financial crime and fraud.

Governments should regulate the cryptocurrency sector to safeguard investors from possible criminal activities and scams. However, regulation should not be too restrictive and should let innovation continue freely.

4. Uncertainty Regarding Taxation

Taxes on cryptocurrencies are levied by different governments at varying rates of severity.

Before making any investments in digital currency, potential investors need to be made aware of any potential tax implications. It is of the utmost importance, therefore, for nations to establish transparent taxation laws for cryptocurrencies.

As a result of better taxation laws and governance, the market will become more reliable and stable, which will lead to a rise in the number of people adopting digital currencies.

5. Security Risks

Theft and hacking are serious risks associated with using digital wallets to store cryptocurrency holdings. For the sake of protecting their digital assets, investors are advised to implement many layers of protection, including the use of strong passwords and two-factor authentication.

In addition, cryptocurrency exchanges should have robust security procedures and conduct periodic audits to ensure the protection of the assets belonging to their customers. Finally, in order to keep their investments safe, investors need to choose secure wallets that they can rely on.

These security concerns are expected to become less common as time passes and the cryptocurrency market matures.

6. Transaction Irreversibility

Transactions involving cryptocurrencies are irreversible, which means that once a transaction is completed, it cannot be canceled or reversed.

Due to this transaction’s irreversibility, people should be careful while investing in digital currency because there is no way for them to get their money back if they make a mistake while using it.

Before investing in cryptocurrencies, investors need to do their own research and make careful decisions.

7. Scalability Issues

There are scalability difficulties with cryptocurrencies, which means they may not be able to process enormous quantities of transactions at once. This might make them difficult to utilize for routine transactions, since these transactions may take too long to process and complete.

Additionally, scalability difficulties may potentially lead to higher transaction costs because of increasing competition for block space.

To address this problem, developers are always developing new scaling technologies and protocols for cryptocurrencies.

Ultimately, these advancements should make cryptocurrencies simpler to utilize for routine transactions.

8. Lack of Merchant Adoption

A lot of companies are hesitant to embrace cryptocurrencies because of how volatile the market can become and how little regulation there is to control their movement.

If more merchants accept digital currencies, it would be much easier for people to spend their cryptocurrency holdings without first having to convert them to fiat cash.

This would make the adoption of cryptocurrency far more widespread.

To encourage merchant adoption, governments should provide financial incentives for businesses to utilize cryptocurrency payment methods and help bridge the gap between digital money and traditional banking systems.

9. Network Congestion

The use of cryptocurrencies by an increasing number of individuals puts a burden on the existing blockchain networks that are necessary for their operation. Because of the increased probability of slower transaction times, it may become more challenging for companies to accept digital payments.

To solve this problem, developers are working on new technologies that will boost the speed and scalability of cryptocurrencies.

One example of these new technologies is the Lightning Network, which is an innovative scaling solution to the age-old problem of limited scalability in blockchain technology.

In addition, governments should provide monetary support to enterprises to encourage the improvement in their infrastructure to manage digital currency.

This will help in lowering the amount of traffic on the network, thus, making it easier and more profitable for companies to accept cryptocurrency payments.

10. Lack of Trust in Digital Currencies

Trust in digital currencies may be improved if more individuals are made aware of the advantages of cryptocurrencies and begin to use them as a form of payment.

In addition, governments should maintain their oversight of the cryptocurrency business to make sure that it remains risk-free for investors and users alike.

Finally, developers in the crypto space should focus on simplifying and enhancing security measures, as well as building wallets that are appealing to users, to make investing in digital currency simpler and safer.

This will help to create confidence in cryptocurrencies and will make it easier for them to be accepted by the majority.

The Future of Crypto Adoption

The future of crypto adoption is uncertain, but there seems to be a general sentiment that it will continue to rise in popularity. The blockchain technology underlying cryptocurrencies has proven to be revolutionary in so many ways, with a wide range of applications being explored continuously.

From its early beginnings as simply a digital currency, cryptocurrencies have evolved into something much more complex, versatile, and promising.

The most significant factor driving the adoption of cryptocurrencies today is the increase in their acceptance by mainstream businesses, financial institutions, and even governments of some countries.

Over the past few years, there has been an influx of companies and institutions offering services related to cryptocurrencies, particularly Bitcoin. This includes popular payment processing companies such as Square, Stripe, and PayPal.

Another factor that is likely to contribute to the continued growth of crypto adoption is the increasing number of use cases for blockchain technology.

Blockchain can be used to securely store and share data, and the use cases are endless. For example, blockchain is being used to enable secure voting, track the origins of goods and services in supply chain management, and facilitate smart contracts across the globe.

The future of crypto adoption is also being shaped by advances in technology. There have been significant developments in areas such as artificial intelligence and machine learning, which can be harnessed to make cryptocurrencies more secure and user-friendly in the future.

Final thoughts

Overall, several challenges must be addressed before cryptocurrencies can become widely adopted by mainstream society. From a lack of education to regulatory uncertainty to security issues, these challenges must be overcome if we want mass adoption of cryptocurrency to occur any time soon.

Companies need to invest in the education of potential users while governments need to provide clear guidance on how they plan to regulate digital currencies so that investors feel more secure in their decisions.

In fact, as of 2022, around 8% of all the Bitcoin in the world is owned by governments and companies.

Finally, exchanges need to invest heavily in better security measures while individuals should practice good security habits when dealing with cryptocurrency transactions or investments. If all these challenges can be overcome, we may see the mass adoption of cryptocurrency occur sooner rather than later!

Are you looking for a trusted name in time-stamping services for your files, data, and digital assets? Get started by signing up today!

Stay informed with the latest insights in Crypto, Blockchain, and Cyber-Security! Subscribe to our newsletter now to receive exclusive updates, expert analyses, and current developments directly to your inbox. Don't miss the opportunity to expand your knowledge and stay up-to-date.

Love what you're reading? Subscribe for top stories in Crypto, Blockchain, and Cyber-Security. Stay informed with exclusive updates.

Please note that the Content may have been generated with the Help of AI. The editorial content of OriginStamp AG does not constitute a recommendation for investment or purchase advice. In principle, an investment can also lead to a total loss. Therefore, please seek advice before making an investment decision.

How to Create a Bitcoin Blockchain Address: A Step-by-Step Guide

Discover the process of generating a Bitcoin blockchain address through our detailed step-by-step tutorial. Get started with cryptocurrency now!

Is the Bitcoin Dream Dead in 2023?

Bitcoin has been around since 2009, but it has still to witness mainstream adoption. Despite the massive success of Bitcoin in the crypto space, there are still those who claim that it's all hype and nothing more than a fad.

The History of Stablecoins: The Reason They Were Created

Stablecoins play a significant role in the crypto space. Who created them and why?

Protect your documents

Your gateway to unforgeable data. Imprint the authenticity of your information with our blockchain timestamp