DeFi vs. Bitcoin: Exploring Key Differences and Unique Benefits

Salomon Kisters

May 16, 2022This post may contain affiliate links. If you use these links to buy something we may earn a commission. Thanks!

There’s a lot of talk about DeFi (decentralized finance) lately, but what is it, and how does it compare to Bitcoin? In this post, we’ll look at the key differences between DeFi and Bitcoin and explore why each has its own unique benefits.

The two terms, DeFi and Bitcoin, are used side by side so much that many people think both are the same thing. Yet, blockchain, the technology that makes both DeFi and Bitcoin possible, has come a long way since Bitcoin was first introduced in 2009.

Now, there are altcoins and NFTs (non-fungible tokens) and DeFi that extend beyond cryptocurrencies like bitcoin into the world of finance while still maintaining its original purpose - limitless transparency through Smart Contracts!

Let’s look at the most important factors differentiating DeFi from Bitcoin and how the use of this technology can help us move towards financial freedom.

A Brief Journey from Bitcoin to DeFi

Bitcoin was first released on January 3, 2009, by a pseudonymous developer (or group of developers) named Satoshi Nakamoto.

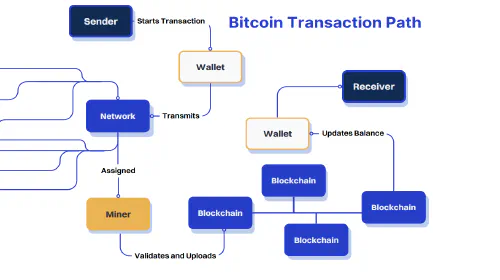

Bitcoin uses a decentralized blockchain in the form of a digital ledger with thousands of nodes spread around the globe. This digital ledger keeps a record of every transaction that has ever been made on the network.

The ability of the Bitcoin blockchain to enable users to make anonymous transactions without the need for a third party is what made this technology so special. On top of that, the code is kept open-source so that anyone can test its authenticity.

Our current financial system lacks both: anonymity and transparency. This led the experts to believe Bitcoin to be the successor to the conventional financial system that is based on centralized institutions. In essence, Bitcoin opened the gates to a new financial future.

However, the spectrum was broadened greatly with the launch of Ethereum in 2014. This new blockchain had something called smart contracts embedded into its mechanism. Smart contracts are programs that are automated when certain conditions are met.

The picture of what this new generation of blockchain can do became clear in 2017, thanks to the launch of non-fungible tokens (NFTs). People soon realized so much more could be done with blockchain technology.

The turning point came in December 2017, when the first decentralized autonomous organization (DAO) was launched. MakerDAO allowed people to lend and borrow their crypto funds without the involvement of any bank or governmental body. The entire procedure is controlled by smart contracts. This marks the birth of DeFi.

Since MakerDAO, hundreds and thousands of DeFi services have evolved on different blockchains, including Ethereum. From borrowing and lending to insurance, asset management to KYT compliances, and derivatives to decentralized exchanges, the DeFi industry transcends all kinds of limits and barriers.

What Makes Bitcoin and DeFi Different?

The difference between Bitcoin and DeFi can best be explained with the analogy between email and the internet.

When the internet was first released to the public, all it allowed was emails. People could interact with each other using this super-fast technology, and they thought this was what the internet was all about.

But within the next few years, as the internet technology began to evolve and spread, everyone realized it wasn’t limited to just emails, but this was an entirely new world with numerous possibilities.

Similarly, when the blockchain world was all about Bitcoin, it was great. People loved it. It allowed them to make anonymous money in P2P (person-to-person) transfers independently. But in less than a decade, we discovered the true potential of this technology.

It was not just one feature that made making payments quicker and cheaper with blockchain. It was an entire system where you could do everything that included the use of money. It liberated the individuals from banks and financial institutions.

What Binds Bitcoin and DeFi Together?

The underlying technology, blockchain, keeps Bitcoin and DeFi together. Despite all their differences, it is necessary not to think of Bitcoin as something entirely different from DeFi. In fact, we should think of it as an essential component of the bigger decentralized financial world.

People cannot use real-world money to execute all the amazing operations DeFi allows them to do. Since using paper money or fiat currencies, such as USD or Euro, involves banks and centralized organizations, it directly contradicts the principles of DeFi. That makes Bitcoin and other crypto tokens - a digital store for value - functional as governance currencies of the DeFi world.

Fundamental Pillars of DeFi

Discussing the entire DeFi sector or how it works would be impossible to cover in just one article. However, the following five elements pretty much comprise most of what we call DeFi.

Stablecoins

Stablecoins are a bridge between the traditional financial system and DeFi. They have their value backed by a fiat currency in such a way that their price never fluctuates. For example, stablecoins, like Tether, DAI, and USD Coin, have their price tied to the United States Dollar.

Suppose you want to purchase a commodity within the DeFi using a fiat currency. You would first have to make a transfer from your bank account to a centralized exchange, such as Coinbase or Binance. Then you would use the exchange service to purchase that asset.

Suppose you want to sell that asset because you would have to use the exchange’s services again. And after you receive your money from the exchange, you will be required to transfer it to your bank account.

The entire procedure involves going through several centralized bodies and paying each of them their fees. On the other hand, with stablecoins, you’ll have to buy them just once and then trade them in and out for any digital asset. It will be much faster and cheaper.

Lending and Borrowing

A significant portion of the current financial system (both macro and micro scale) is based on lending and borrowing money. Traditionally, individuals need to put something down as collateral to lend or borrow money from the banks. The interest rate on some of these loans can be terribly high, sometimes going up to 20%-25%.

However, in the DeFi space, users are able to work with others by allowing them to use their funds without giving away their custody. This is all possible with the use of smart contracts. If a person wants to earn some interest on his crypto holdings, they can simply go to AAVE - the biggest crypto lending platform - and deposit their funds into a smart contract. In return, they get specific tokens that are equivalent to their original deposit, plus the interest.

This procedure involves no individual or organization to calculate or complete the transaction; the automated code does it all! Hence, there is no such thing as the monopoly of a centralized entity in the system.

Decentralized Exchange

Decentralized exchanges, or simply DEX, are a significant part of the DeFi industry. They allow the users to trade different assets, such as NFTs and cryptocurrencies, at incredibly low fees.

For the sake of comparison, let’s take an example of forex exchanges which let people trade one fiat currency for another. Like any other exchange in the world, they charge their customers an exchange fee.

But the problem is that the rate for this fee is derived from several factors, including federal taxes and the personal interest of the exchange owners.

A decentralized exchange, however, is not owned or governed by a single entity. In contrast, the blockchain code regulates every aspect of it.

Everything, including the trading fee, is pre-determined and written into the code so that it can never be altered. You can comfortably trade your funds by paying just a minimal fee, usually <1%.

Flash Loans

Flash loan is a pretty novel concept where an individual takes a hefty loan to purchase an asset from an exchange and sell it on another platform where the price is a bit higher, then return the loan while keeping the profits.

The entire process is completed in a matter of seconds.

Flash loans help the DeFi space improve the price stability for different digital commodities and strengthen the crypto-economic structure.

Insurances

Crypto insurance works pretty much the same way as real-world insurance policies. They help you recover your losses by offering you monetary compensation, and in return, you pay them a fee.

But the difference is, unlike regular insurance firms where people calculate and assess the risk, everything is done by the blockchain code for DeFi insurance.

Final Words

DeFi and Bitcoin are different technologies, but both have the potential to revolutionize how we interact with the world. DeFi is focused on building decentralized applications that make it easier for people to use their money without relying on a third party, while Bitcoin is all about creating a new form of digital currency that can be used for transactions online.

Both technologies have their own benefits and drawbacks, so it’s important that you always do your research and get informed on OriginStamp, Crowdwiz, or other similar websites.

Stay informed with the latest insights in Crypto, Blockchain, and Cyber-Security! Subscribe to our newsletter now to receive exclusive updates, expert analyses, and current developments directly to your inbox. Don't miss the opportunity to expand your knowledge and stay up-to-date.

Love what you're reading? Subscribe for top stories in Crypto, Blockchain, and Cyber-Security. Stay informed with exclusive updates.

Please note that the Content may have been generated with the Help of AI. The editorial content of OriginStamp AG does not constitute a recommendation for investment or purchase advice. In principle, an investment can also lead to a total loss. Therefore, please seek advice before making an investment decision.

Benefits of Private Blockchain: Security, Transparency, Fast Transactions, and More

Private blockchains offer enhanced security, full transparency, fast transactions, negligible fees, no disputes, and medium scalability, making them ideal for businesses.

How to Create a Bitcoin Blockchain Address: A Step-by-Step Guide

Discover the process of generating a Bitcoin blockchain address through our detailed step-by-step tutorial. Get started with cryptocurrency now!

Blockchain 1.0 vs. 2.0 vs. 3.0 - What's the Difference?

Blockchain is a disruptive technology that has been around for 40 years. But what's the difference between Blockchain 1.0, 2.0, and 3.0?

Protect your documents

Your gateway to unforgeable data. Imprint the authenticity of your information with our blockchain timestamp