Blockchain in Real Estate: How the Future Is Changing

Salomon Kisters

May 25, 2021This post may contain affiliate links. If you use these links to buy something we may earn a commission. Thanks!

Most people are familiar with blockchains due to cryptocurrency. However, the blockchain’s potential goes far beyond digital coins. One of the most hotly anticipated uses for blockchain is in the real estate industry. Real estate has traditionally been slow to adopt new technology as an industry, but it’s not for lack of desire to improve and advance.

The sector depends on other traditional industries like banking and law. Mountains of paper, multiple parties, and 10s of names you’ll never put a face to are the norm when buying or selling a house. But not for much longer. Blockchain has the potential to completely disrupt the real estate sector and fundamentally change how we buy and rent houses in the future.

And in some places, it’s already happening. But why real estate? Put simply, the industry has a unique set of problems that blockchain is perfectly primed to solve. With this in mind, let’s take a look at the impact of blockchain on the future of real estate.

Cutting Out the Middlemen With Smart Contract Technology

Buying a house is typically a lengthy and expensive process. When you buy or sell a property, the transaction has to go through a legal process called conveyancing involving banks, brokers, and lawyers. At best, this process can take a few months, and at its worst, it can take upwards of a year.

And then there are all the added expenses. While attorney’s fees vary depending on the state and the complexity of the transaction, most buyers and sellers can expect to pay 0.5%-1.0% of the selling price. Currently, both sides need their own attorney because they need to ensure the contract is in each of their best interests. On top of this, you have to pay a real estate agent or broker’s fee.

This fee is often negotiable, but the standard rate is 6% of the selling price. But just how expensive is buying a house on top of the house part? As of 2017, buyers could expect to pay between $6,422 and $16,066 in closing costs. Four years on, we can only expect that figure to be higher.

As it stands today, the legal aspect of buying a house can be prohibitively expensive for some buyers. Buyers have to ensure they have enough money to cover the legal fees in addition to the down payment before they take action to buy. This can add stress and additional time to an already slow and expensive process. But it doesn’t have to be this way; blockchain smart contracts offer a better alternative.

Traditional Contracts vs. Smart Contracts

First, let’s take a look at some of the issues with traditional real estate contracts. Conventional contracts describe mutual terms of agreement for the sale of the property. However, the wording in these contracts can often be ambiguous and be interpreted in multiple ways.

This is precisely why each party needs a lawyer and why lawyers are so costly - property law is complex, and arguments are inevitable. Smart contracts don’t remove all complexity, but they can be designed to add ultimate clarity.

Before we go any further, let’s remind ourselves what a smart contract is. Essentially, a smart contract is a self-executing contract where the terms of agreement between the buyer and seller are written into the code. When the conditions outlined in the contract are met, the code will execute the transactions. While it’s possible to create smart contracts for almost any transaction, there’s a lot of buzz surrounding their potential in the real estate industry. But why?

Smart contracts cut out the realtor and allow the entire buying and selling process to be conducted between the buyer and seller with a neutral central coordinator. Loans and mortgages can be programmed into the smart contract, and multiple smart contracts can be connected together to cover all aspects of conveyancing.

They can also outline what happens if things fall through. Executions of the code are autonomous, transparent, and instant. For example, all parties would know the moment the buyer completes the down payment. This is a significant improvement on the current system, where all parties have to wait for updates after things get moving.

While there are certainly challenges to smart contracts in real estate becoming commonplace, they aren’t some futuristic pipe dream. In fact, some companies are already championing the sale of property through smart contracts. For example, PropertyClub uses blockchain technology and smart contracts to conduct real estate transactions, allowing users to buy property with cryptocurrencies like Bitcoin. They aren’t the only one out there, either.

Platforms and Marketplaces

In the real estate market, a whopping 93% of home buyers use online websites when searching for a home in the US. These websites, primarily real estate marketplaces and platforms, connect buyers and sellers and offer distinct benefits.

They promote a much more comprehensive and diverse view of the properties available in a given area and allow potential buyers to use filters to drill into the specific criteria of their ideal home. However, real estate marketplaces aren’t without their issues.

Firstly, the property data hosted on these platforms is often inaccurate, outdated, or incomplete. Furthermore, sometimes the data can become fragmented across several listing platforms, leading to confusion. But fear not - blockchain can solve this problem.

The Benefits of Blockchain For Real Estate Platforms:

A single decentralized database - Instead of agents or sellers having to manually input property details into multiple platforms, they can do it once into the blockchain database.

Immutable data - Data submitted to the blockchain is permanent and can not be changed. This prevents the data from being manipulated or interfered with by third parties. It also gives users more control over their data.

Real Estate Marketplaces with Cryptocurrency

In the not-so-distant future, it could become common to complete sale and rental transactions entirely online. Essentially, these marketplaces would allow sellers to tokenize their real estate assets, in this case, a house. But what does it mean to tokenize a real estate asset? In a nutshell, tokenization is a form of securitizing an asset - breaking it into shares that you can sell to investors.

For example, a seller could create a real estate token to represent the shares of a property. They might choose to offer one share per square foot of the property, but they could just as easily offer one share per square inch if they wanted to attract a broader range of investors.

If real estate tokenization becomes popular (and there’s no reason it shouldn’t), it will make it dramatically more accessible and cheaper for investors to buy and sell real estate. It will also make it easier for developers to raise capital for costly projects. For investors, real estate is attractive because it has historically offered consistently high returns.

However, real estate investment has long been a playground for the wealthier among us. The barriers to entry are simply too high for most people because the assets are so expensive. You don’t wake up on a Sunday morning and decide to invest in a house - a few shares in an up-and-coming startup, maybe - but not a house.

Tokenization introduces the concept of fractional ownership. Instead of buying an entire property, you can own parts of many properties. Fractional ownership also allows investors to pool their money to buy very expensive properties that would usually be off-limits. Additionally, it frees investors of the other costs associated with purchasing a property, like maintenance and leasing.

In effect, tokenization changes the playing field. Not only does it lower a barrier to entry for real estate investing, but it offers a uniquely attractive route to investing - the high returns of real estate combined with the liquidity of the stock market. Additionally, real estate tokens are backed by tangible assets, making them far less risky and volatile than cryptocurrencies.

There is already movement in this area. For example, a company called ATLANT has developed a blockchain platform that facilitates real estate transactions. Users can tokenize their assets and liquidize their assets quickly.

Property as a Liquid Asset

Property has long been considered an illiquid asset. In fact, it’s regarded as one of the least liquid assets you can invest in. Liquid assets are those that you can convert into cash at fair prices within a short time (typically within days). Essentially, they are viewed much the same as cash itself. Examples of liquid assets include stocks, bonds, cash, exchange-traded funds (EFTs), and mutual funds.

Real estate doesn’t meet these requirements, making it an illiquid asset. Selling real estate can take months, and there’s typically no way to get that cash quickly.

However, with blockchain for real estate, it’s highly likely we’ll live in a future where property is considered a liquid asset. The major limiting factor in whether something can be considered liquid or not is time. Tokenizing real estate would allow investors to convert their property tokens to fiat currency very quickly.

It’s strange to think we’re heading to a future where today’s most illiquid asset will become one of tomorrow’s most liquid assets. But that’s precisely what cutting edge technology does; it transforms the world around us and soon the old way of doing things looks unrecognizable.

Decentralized Transactions via Real Estate Blockchain

One of the defining features of blockchain is decentralization. The concept can seem confusing to many people because almost everything you interact with on the internet today is centralized. If you’ve ever used Facebook, YouTube, Twitter, Amazon, your bank account, you’ve experienced a centralized process.

In a centralized system, data needs to be verified by a third-party intermediary on your behalf. This third party, for example, Facebook, acts as a single authority and retains total control over the network. There’s no way to engage with Facebook without your activity data being stored on their servers.

By contrast, decentralized networks are made up of computers (also called nodes) that interact without the need for third parties. In a decentralized network, information is sent on a peer-to-peer basis to every single computer on the network.

Why Are Decentralized Networks Better?

In a centralized system, there is a single authority and therefore a single point of failure. You have to trust the company with your data and hope they put the necessary steps in place to prevent a data breach. If the company’s servers are compromised, your data can be manipulated and it can be very difficult to recover it or prove what it was in its original form.

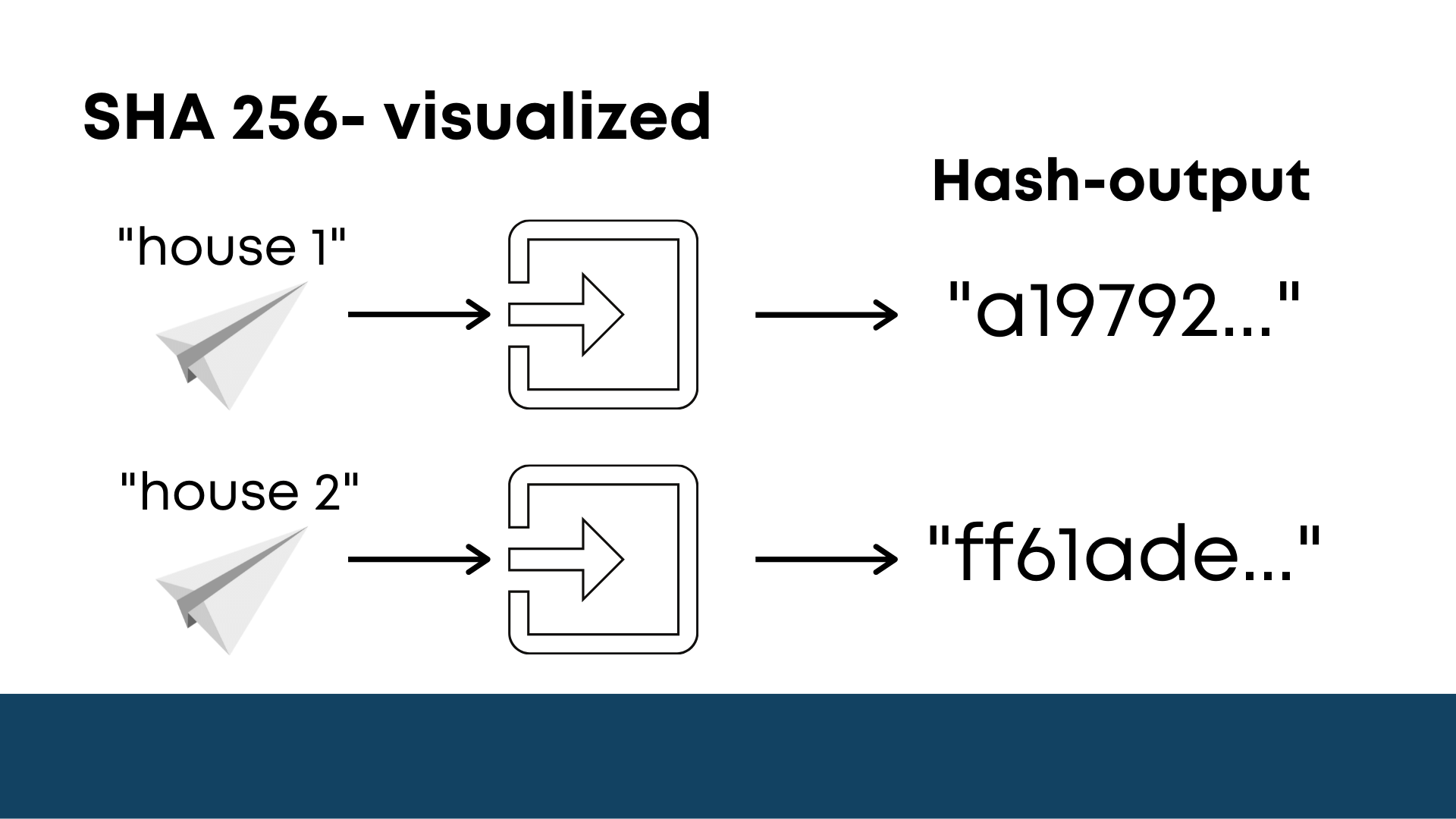

By contrast, you can not manipulate data already on the blockchain - it’s permanent and unalterable. Without getting too much into the specifics, immutability is achieved through hashing (converting a string of characters into another value through an algorithm). Each transaction is hashed and embedded into a ‘block’, and each subsequent block contains data about the previous block.

This means that hackers can’t break into the blockchain and change the values because all subsequent blocks would no longer follow the logical pattern - the blockchain would break and the chink in the chain would be immediately noticeable.

Just how noticeable is attempted tampering? Very. Most blockchains use the hash SHA-256. With this hashing algorithm, changing even one character dramatically changes the resulting hash. Take a look:

If a fraudulent change is made in the blockchain, all subsequent blocks leading on from the fraudulent one are automatically rejected.

The Benefits of Blockchain Real Estate

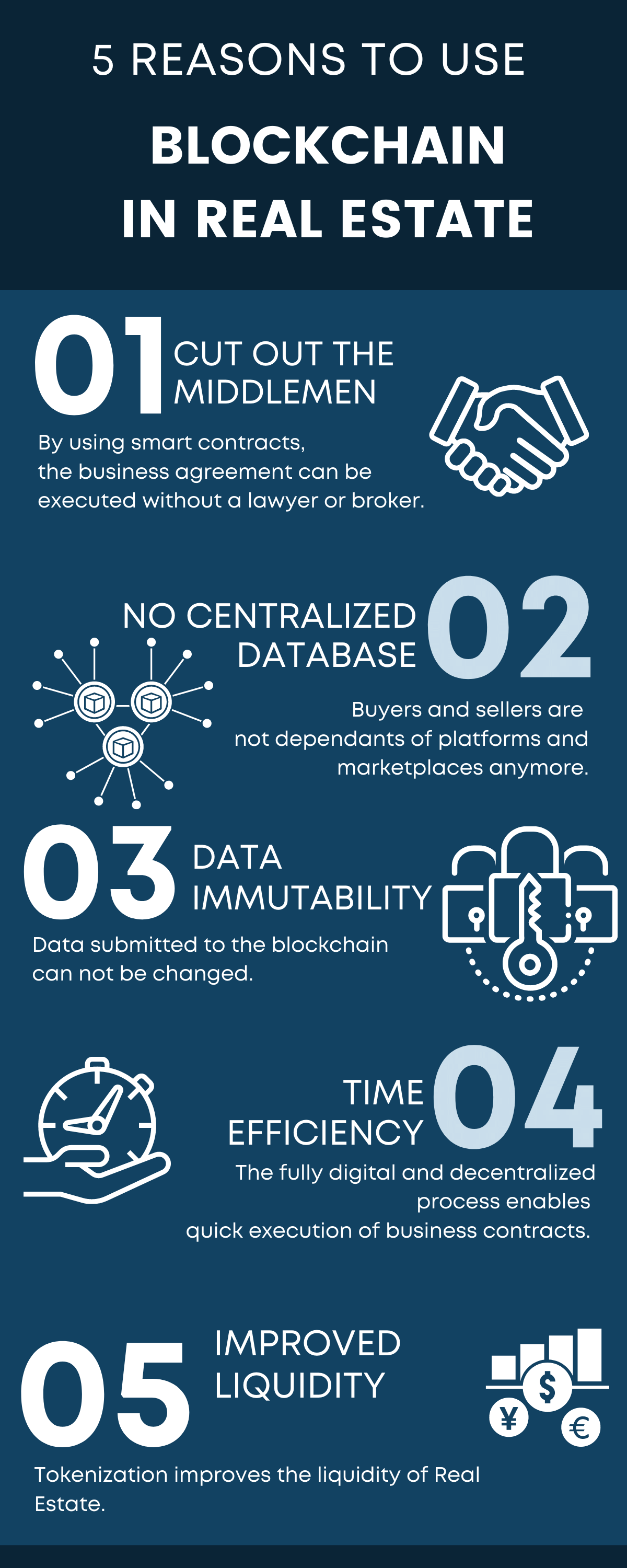

Here are some of the top benefits of decental, blockchain real estate:

- Buyers and sellers can have more confidence in transactions since fraud attempts are essentially eliminated.

- The tamper-proof characteristic of the blockchain database could replace siloed databases and allow any real estate business to compile data and documents from many shareholders in a distributed manner.

- Decentralized ledgers are autonomous and pave the way for a paperless future. Not all costly mistakes are the result of fraud. Oftentimes, they’re caused by human error.

- Real estate companies deal with highly sensitive information and as a result, having a single point of weakness can be catastrophic. With a decentralized process, the likelyhood of data loss data under normal circumstances is very low.

A Crypto Powered Paperless Future

Buying a property typically involves a ton of paperwork in the form of deeds, offer letters, loan estimates, home inspection reports, seller disclosure statements, the bill of sale, and the seller’s certificate of title. Most times, you’ll be entrusted with keeping a hard paper copy of these documents.

However, it should come as no surprise that there are several problems with paper documents. For example, paper deeds are often only held by the bank or mortgage company for the mortgage’s duration. The banks always want to have the deed on hand in case they need to repossess your property. Therefore, you shouldn’t rely on the bank to keep a copy of your deed that you can ask to retrieve whenever you want - you need to preserve and protect a copy yourself.

It’s generally recommended that you keep all of your contract papers related to your home purchase for the duration of the loan, and preferably longer. But why longer? Well, there’s no statute of limitations on the IRS pursuing you for failing to file a tax return in any given year . For this reason, the IRS recommends you keep these records indefinitely.

There are also other problems with paper copies of essential documents. Although it’s not particularly common, deeds can be edited or forged, allowing fraudsters to sell properties they don’t own. And of course, while paper is somewhat robust when stored correctly, it can degrade quickly in the wrong environment. Unknowingly leaving your paper documents in a damp garage could make the documents unreadable in just a few short months. This can be a massive problem if you’re ever asked to produce them. Deeds can also be vital if you have disputes with your neighbors over land boundaries.

Okay, so paper documents aren’t great, so why aren’t we storing them 100% digitally today? Because currently, many times the digital options aren’t much more secure than paper, if at all. Any digital documents in the traditional real estate system will be stored on centralized servers. Sure, your deed isn’t at risk of getting damp or setting on fire, but it can be stolen by cybercriminals or deleted in an IT disaster.

The risky nature of paper and conventional digital storage is accelerating the need for blockchain in real estate and all other industries. Blockchain for business is rapidly becoming a reality, and many companies are already making the shift to a blockchain-based way of handling their data assets.

The best thing you can do right now is to store the hash value of any critical digital documents you have on a secure blockchain like Bitcoin, Ethereum, or others. This way, you can safely prove a document of your choosing had a specific condition at a given point in time. To save you the trouble of implementing and getting software that does this process for you, we at OriginStamp have a working API ready for your use.

With OriginStamp, you can timestamp your files, data, and documents and protect them from fraud and manipulation. By timestamping your files, you can prove the authenticity and ownership of your documents and leave no room for doubt. Not only can you keep your sensitive data safe and prove it belongs to you, but you can also prove it has never been tampered with.

In other words, OriginStamp is blockchain-powered data confidence.

Stay informed with the latest insights in Crypto, Blockchain, and Cyber-Security! Subscribe to our newsletter now to receive exclusive updates, expert analyses, and current developments directly to your inbox. Don't miss the opportunity to expand your knowledge and stay up-to-date.

Love what you're reading? Subscribe for top stories in Crypto, Blockchain, and Cyber-Security. Stay informed with exclusive updates.

Please note that the Content may have been generated with the Help of AI. The editorial content of OriginStamp AG does not constitute a recommendation for investment or purchase advice. In principle, an investment can also lead to a total loss. Therefore, please seek advice before making an investment decision.

Ethereum: Decentralized Blockchain Platform & Use Cases

Learn about Ethereum, a decentralized blockchain platform with smart contract functionality. Explore its use cases, how to buy Ether, and the benefits of OriginStamp.

How Blockchain Technology Benefits Everyday Business Owners

Blockchain technology offers numerous benefits to everyday business owners, including establishing trust, enabling value transfer, establishing contracts, providing timestamps, implementing smart contracts, facilitating audits, and offering custom solutions.

Proof of Existence on Blockchain - The Complete Guide | OriginStamp

Learn about Proof of Existence on Blockchain and its significance in maintaining non-repudiated logs of actions. Explore use cases like Georgian Government, Bloxberg, Certify DApp, and Signatura.

Protect your documents

Your gateway to unforgeable data. Imprint the authenticity of your information with our blockchain timestamp