The State of Blockchain in the Insurance Industry: How Trustable Transactions, Enhanced Transparency, and Automation Can Disrupt Everything

Fabian Beck

Jul 21, 2021This post may contain affiliate links. If you use these links to buy something we may earn a commission. Thanks!

Insurance is one of those industries that has faced a lot of disruption in years as technology has entered the space in a serious way. Traditionally, insurance relied on a vast network of brokers who worked tirelessly to win new clients and build their books through one on one interactions. The same level of manual activity was required for the claims process as well, due to excessive paperwork and bureaucracy. As such, it was quite a stagnant industry for a while, until we started to see new players enter the space and rethink how these organizations could be run.

What’s interesting to see is that many of these players have also come from outside of financial services and have been applying some of the key innovations that we’ve seen in other verticals to insurance and getting some amazing results while doing so. It seems that there still is plenty of disruption to come as we work through what the insurance companies of the future will look like. It’s safe to say that they’re going to look very different to what we have today.

One of the most important breakthroughs that have had an impact on this paradigm shift has been the advancements we’ve seen in blockchain technology. The developments we’ve seen over the past few years have been monumental and insurance is one of those industries that really stands to benefit from some of the exciting new possibilities that this technology can create.

In this article, we’re going to do a deep dive into some of the most exciting applications of blockchain technology in insurance and see just how transformational it can be.

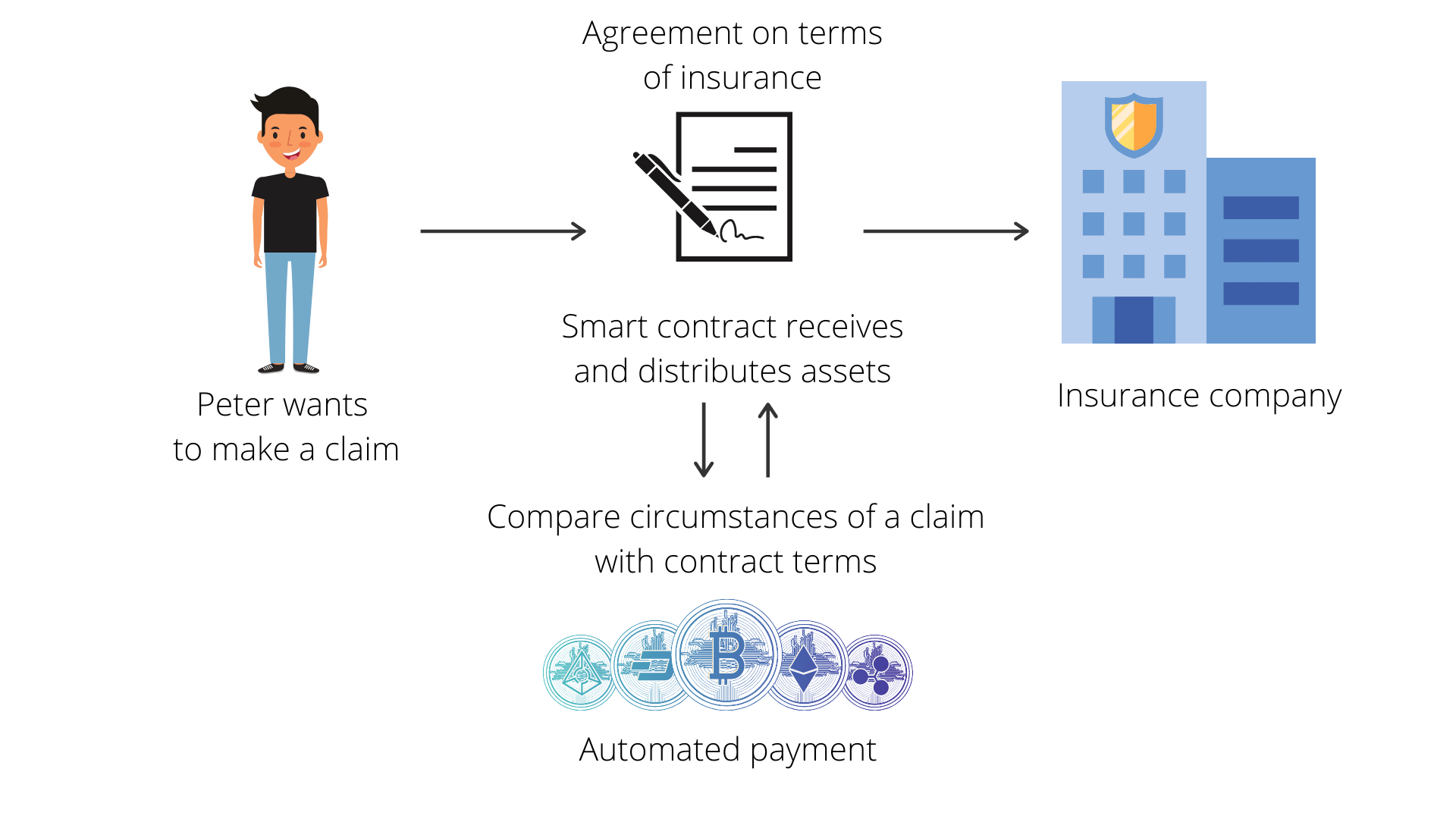

Smart Contracts

Let’s start with the most foundational piece of this equation – the smart contract. This refers to a digitally signed contract agreement between two or more parties that can execute automatically when a certain event is triggered. In other words, it is a programmable contract. This is disruptive because, with traditional contracts, you require an arbiter of truth who is going to determine whether either party has met the agreement – and so you still carry the risk that you won’t receive your end of the deal. Smart contracts can act as the arbiter independent of each party, only executing when an agreed event has objectively occurred.

You should be able to immediately see how this might impact insurance. The very nature of an insurance contract is that the client wants to get paid out for their claim in the event that something specific happens. But they are at the mercy of the insurance company who is incentivized to do anything they can to void the claim. If you were to use a smart contract, however, there wouldn’t be any nasty confrontations because the event is fixed in advance and the contract would pay out immediately – without allowing either party to veto it. This should serve to make a much fairer and more transparent transaction between parties for a much smoother claims experience.

And when you look at it from the other side of the coin, it’s difficult to understate just what this could mean when it comes to fraud prevention. The present system relies on the person who is making the claim to provide an accurate and truthful report of what happened in order to adjudicate whether that claim is valid and should be paid out. The insurance company will go to whatever lengths they can to prove that occurrence and validate the claim, but they can only go so far. At some point, you just have to take people on their word. Smart contracts open up a range of exciting possibilities to automate these processes in a way that doesn’t allow for fraud in the same way that we see it today. If the triggering event can be programmed into the smart contract then there is no need to trust the person who is making the claim. There is an objective standard that controls that claim and when it happens – the claim will automatically be paid out.

While not perfect for every use case, this simple innovation can make a big difference when it comes to reducing fraudulent claims. We’ve already seen lots of activity in this space as companies start to experiment with this technology – and while it is new, it’s already causing quite a buzz because of what is possible. This is where blockchain technology can completely transcend the social stigma caused by overhyped cryptocurrencies. This is where the power of coding can transform how we interact and transact on a massive scale.

Interaction with the Internet of Things

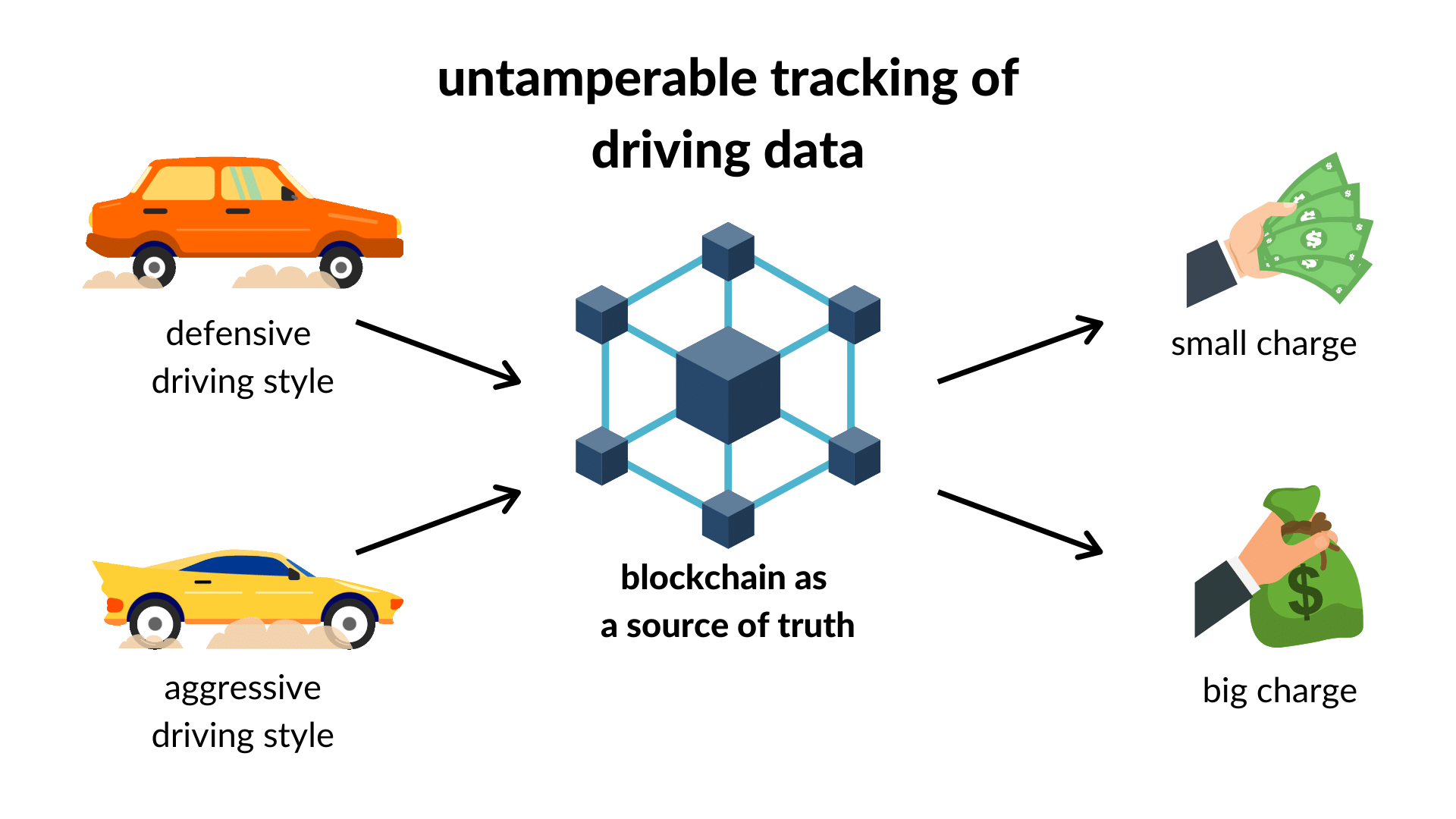

One of the most exciting technological developments we’ve seen over the last decade has been the growth of the so-called ‘Internet of Things’ (IoT). This refers to a proliferation of smart devices of all kinds which can connect to the internet, sending and receiving data of all kinds. This includes home appliances, large pieces of equipment, vehicles, and so much more. All these devices can be connected in interesting ways that open up a range of new functionality and change the way that we think about these objects and how to insure them.

One of the most tangible examples of this is in the field of telematics. In what feels like no time at all, it seems that an entire industry has popped up in front of our eyes. The idea is that you install a small sensor into your vehicle that is continuously tracking your location, speed, acceleration, and other aspects of your driving behavior. These devices serve two main purposes: tracking your vehicle if it gets stolen, and/or holding the driver accountable for the way that they drive.

Many motor insurance companies now insist on these devices because it allows them to assess the risk profile of the driver in a transparent and objective way. This then allows them to calculate the premiums more precisely, helping safe drivers to save money while protecting themselves from the risks taken by poor drivers. More data improves the system significantly here.

You can imagine another application in the business landscape when it comes to equipment or other assets. A smart sensor that monitors the status of that object, how it’s performing, and when it might need maintenance, is worth its weight in gold to insurers. Instead of guessing about the risks that they’re insuring, they can make their decisions based on data and be proactive where needed.

All of these data pieces can be used as specific triggering events that are written into smart contracts and that’s where blockchain technology can play a role. IoT devices can transmit data to a blockchain-based policy and that can be used as the source of truth for upholding each party’s side of the contract. This eliminates the need for trust and allows the entire transaction to be predicated on data that both parties agree to in the conditions of the agreement.

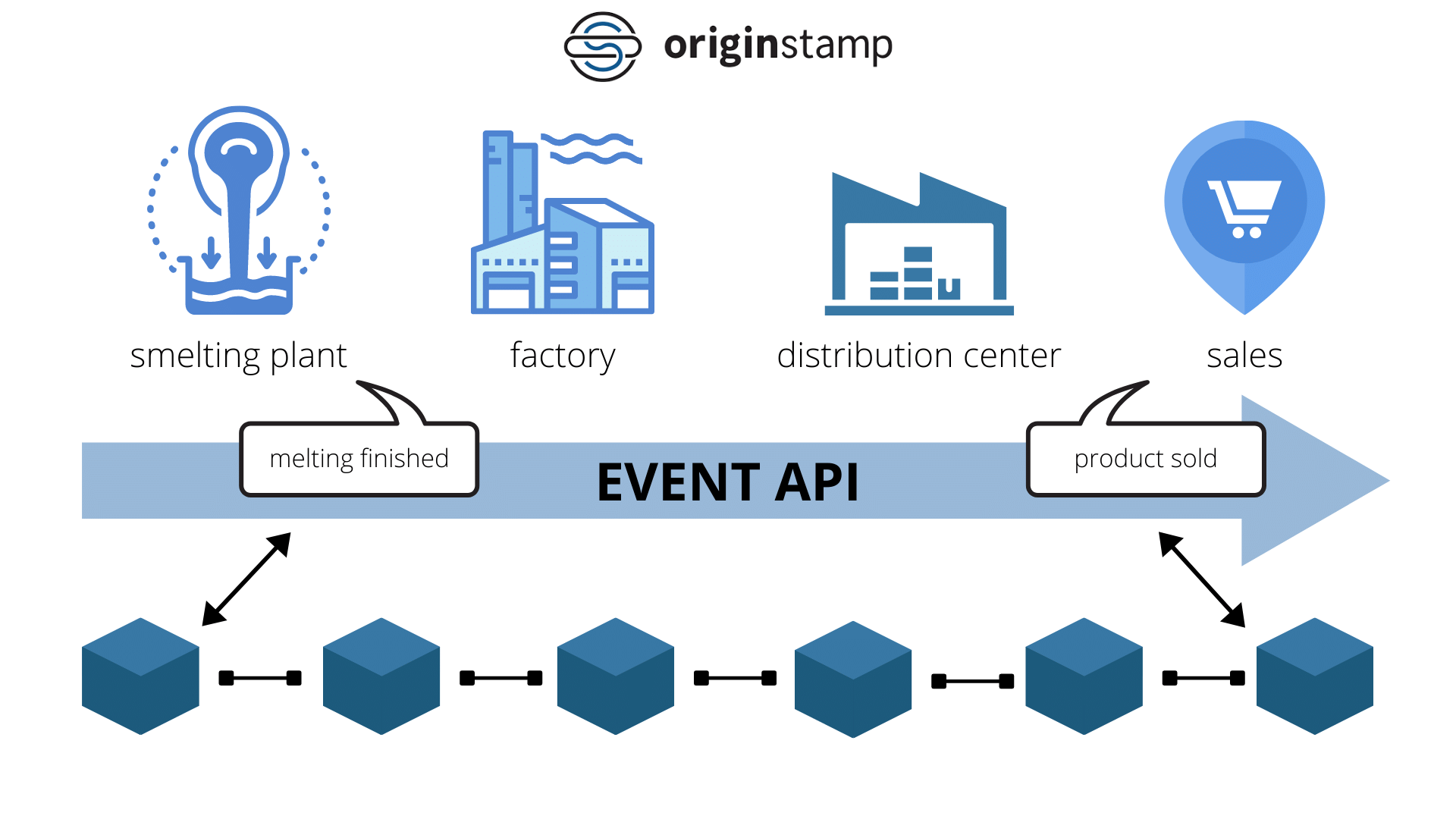

This is one of the areas where the timestamping technology we’re building here at OriginStamp can play a significant role. Each of these events needs to be stamped into the blockchain in a verifiable way and that’s where we’ve seen so many of our clients get value. The data combined with the immutable stamp makes these transactions more efficient and reliable across the board.

Improved Back-End Efficiency

Insurance typically carries a heavy administrative burden because of the range of customer information you’re keeping on hand, the complexities of the legal agreements, and the constant back and forth regarding policies and payouts. As such, your back-end infrastructure is crucially important. It’s what’s going to set you apart from the rest and allow you to build a sustainable, scalable business.

Blockchain technology is a strong contender to take on some of this burden. The very nature of a blockchain-based system is that you have a single, immutable source of truth that can hold whatever key information you’d like. As such, it’s much easier to consolidate your informational structures and you’ll know that you always have the most accurate, precise, and up-to-date data at any one point in time.

Where this really pays off is when it comes to cross-function collaboration. The various teams within insurance companies can tend to silo themselves over time, but if your blockchain system acts as the single focus point for your organization, you’ll be assured that everyone is working from one view of the customer. This greatly improves efficiency and actually delivers a better customer experience at the end of the day. It ensures that everyone is on the same page and is pulling in the same direction.

When you take this to its natural conclusion, this allows for a wide range of automation possibilities within insurance companies because these policies and the corresponding administration can be programmed in ways that just weren’t possible before. Instead of relying on multiple processes to get a deal from a broker right through to a finalized policy, you have one digital asset that you’re managing and anything that is transactional in nature can be completely automated away. This means that you could reduce your staff complement if you wanted to, or you could re-deploy those people to higher-value tasks across your organization.

This is something that is often underrated in terms of its effectiveness. So many companies have become bloated and rely on a Frankenstein-esque combination of systems to run their business. This is a natural by-product of scaling because you’re building as you go. The blockchain provides an opportunity for companies to go back to first principles and find better ways to structure their back-end systems. Instead of various disparate systems which much communicate with each other, you can build on one foundation that is immutable and not subject to change. Everything else then flows from this and you can trust that the information it contains is always accurate, timely, and up to scratch.

The synergies this provides can be the catalyst for any insurance company to get a handle over their data and compound the value for each specific team that needs to act on that information.

Industry Cooperation - Prevent Fraud

From the perspective of the insurance companies themselves, blockchain technology holds a lot of promise in terms of what it can do to combat fraud. As one of the most significant challenges that these companies face, a blockchain-based system can provide the sort of encryption, transparency, and immutable nature that makes it much more difficult to manipulate the system and commit fraud across the entire value chain.

And where the industry differs a lot from others is how interconnected everything is. As insurers compete for business, they are continuously trying to understand the market and assess customers accurately, while trying to protect whatever secret sauce they try to use to establish a competitive advantage. As such, we’ve seen very little in terms of accurate cooperation because the incentives aren’t aligned. This has resulted in systemic risk that creeps in as companies aren’t able to share information. Customers can commit fraud by duplicating their insurance, faking insurance claims, and misstating information about what is being insured.

Blockchain technology creates some unique opportunities for insurers to come together and share vital information without sacrificing any of the competitive nature that is at the heart of the industry and how it works. There are two main ways that the industry could come together and achieve a level of cooperation that would be in everyone’s best interests without giving out competitive information:

Registries of high-value items

We’ve seen a few companies start to work on solutions where high-value items such as houses, cars, and the like could be registered to a centralized blockchain that logs ownership credentials, various terms and conditions, asset information, and so on. This registry could then serve as a single source of truth that cannot be manipulated, which houses the exact ownership information of these items. This would drastically reduce the number of fraudulent insurance cases that come through the system because it would eliminate a lot of the room for gaming the system. In its place, you have a decentralized fixed asset register that can be used to prove ownership and various other pieces of information in a streamlined and efficient way. Anything we can do to track assets digitally and provide transparency into a very opaque system is going to pay off over the long term.

Avoiding multiple insurance policies

When you log your assets and/or insurance policies onto a blockchain it allows for a transparent audit log of those digital assets to be kept without revealing unwanted personal information. This means that when an insurance company is evaluating a new policy, they can very easily check to see if the applicant has any other insurance policies on that particular object. The single source of truth means that it becomes all but impossible to secure multiple insurance policies on the same risk – which is one of the most damaging forms of insurance fraud. It allows for the entire industry to share information in a way that doesn’t reveal any unnecessary details, while still combining forces to ensure that policies are legitimate and not duplicated.

Both of these use cases hold the potential to drastically reduce the losses that the industry suffers every year thanks to clients who commit insurance fraud. All the while, the blockchain can protect sensitive data in such a way that you also manage the privacy concerns that have always been part of the conversation when people have spoken about industry-wide cooperation.

This is also where regulators and other stakeholders can benefit from the increased transparency and the immutable audit trail. Insurance is a highly regulated industry because of its nature but it can be difficult to really enforce legislation efficiently when the industry is siloed in the way that it is. A blockchain-based system would make it significantly easier for regulators to play their role and assuming that the right things are in place, this should create a much better consumer experience as a result. The nature of the audit trail provides a layer of transparency that just hasn’t been seen before on this scale. It could legitimately change the way that the entire industry operates.

Peer to Peer Insurance

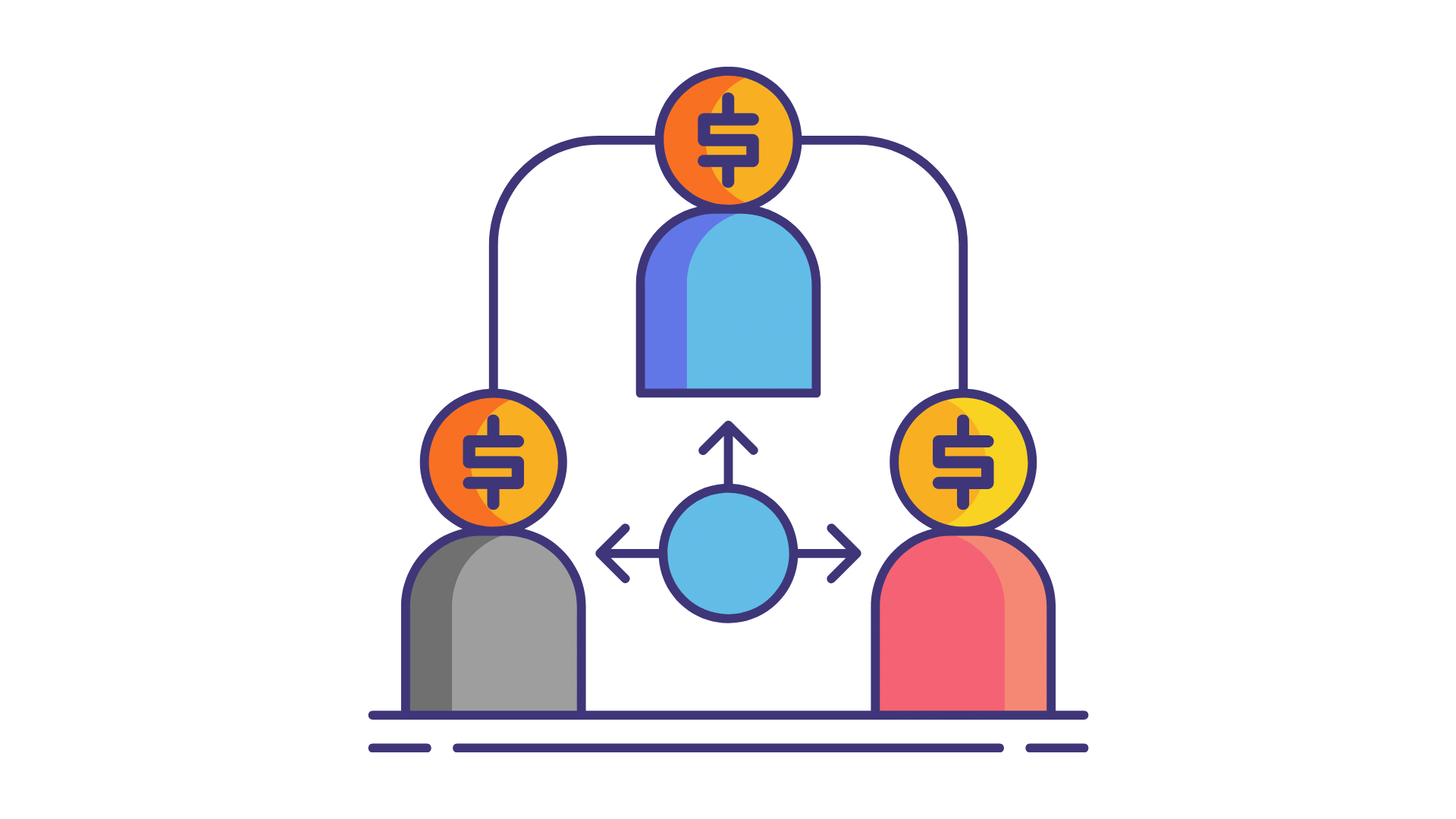

Speaking of disrupting the status quo, let’s look at the opposite side of things, where we might imagine a future where traditional insurers disappear entirely. Blockchain technology threatens to disintermediate major insurance companies because of what it can do in creating trustless transactions.

The current value proposition in terms of insurance is as follows: You pay premiums to an insurance company with the belief that you will be able to claim back your money when a certain event happens. You mandate the company to pool your funds with a large group of others to create the liquidity necessary to manage that risk. For that privilege, you pay over and above what is necessary so that the insurance company can make its profit.

Theoretically, all the people who contribute to that pool of funds could meet up separately and achieve the same results without having to pay margins to the insurance company. But practically, this is very difficult because of the burden of getting a group of sufficient scale, and you simply can’t trust the other people in that group. The insurance company essentially covers the administration and the vetting so that you have peace of mind regarding how your risk has been pooled.

If we now turn our minds towards blockchain, you should be able to see that the immutable nature of the ledger combined with smart contracts can effectively achieve this objective in a decentralized way. You might imagine committing your premiums to a smart contract escrow that manages those funds and only pays out when a specific event takes place. You do this knowing that the encryption of the blockchain provides the security and transparency to give you peace of mind. At the same time, anyone else can contribute to that pool of funds, in the same way, receiving the same protection as you do. You don’t need to know anything about that person, because the blockchain ensures full compliance in an automated way that cannot be manipulated.

This opens up opportunities for complex peer-to-peer insurance in ways that we just haven’t seen before. If this works, it can completely disintermediate insurance companies and drastically reduce how expensive premiums are across every type of insurance policy you can imagine. The regulation here is going to be complicated, of course, because of the stakes of these sorts of financial instruments, but with so many in FinTech and InsureTech pushing for this sort of innovation, it seems like this is more than plausible. Its decentralized finance projects like this that threaten to disrupt the entire industry. Only time will tell how this plays out.

Making Insurance More Inclusive

Building on the section above, these new decentralized insurance policies offer tremendous potential for new types of insurance to emerge. Currently, the industry is somewhat restricted by the conventions of the past and as such, vast portions of the global population are still underinsured. This is especially prevalent in the developing world where traditional insurance is out of the question for so much of the population, and that leaves them incredibly vulnerable to sudden economic shocks that can derail years of progress. Blockchain technology could go a long way towards making these products more inclusive and accessible to all.

When you use blockchain technology to radically transform how these policies are sold, processed, and administered, you can create economic models that are much more efficient. By bringing the costs way down and by removing some of the administrative barriers to entry, you can serve those people around the world who have never had the opportunity to get real insurance.

This is incredibly exciting because it breaks things down to their bare essentials and then allows for new products to be built on top of this technology. Regardless of scale, location, creditworthiness, or anything else – decentralized financial products can bring crucial financial stability to everyone. And it really is a snowball effect. Once a concept has been proven and a new form of insurance has been born, it will prompt an entire industry to be built around it and that’s how you expand the reach of financial services.

For example, one of the things that can impede true financial inclusion is the Know Your Customer (KYC) requirements that are enforced in terms of anti-money laundering legislation. These regulations are imposed with good intentions and they provide a lot of value to the system, but they also make it difficult for people without the right documentation to access the financial system.

Blockchain technology could help us to solidify identity in a digital format that can then be used to provide the necessary transparency for insurance providers. In so doing, the very concept of insurance can reach a much wider audience and deliver the value that we take for granted in the developed world. By leveraging the power of zero-knowledge proofs, anyone can place their identity on the blockchain and have information that is verifiable and yet still protected – in a way that can give insurers the comfort that they need. This eliminates that barrier to entry and makes it possible for people who have never been able to access these products before, the chance to engage meaningfully with these financial instruments. It’s a game changer.

Another example relates to micro-payments, enabled by the blockchain. When you can tokenize these policies and do the transactions on chain, you enable much smaller transactions in an efficient way. All of this with transaction costs slashed to a mere fraction of what they would be if you were to go through the traditional financial system. This sidesteps one of the main barriers to entry in insurance and allows for bite-sized insurance policies that are more adaptable and suitable to different use cases. Instead of having to subsidize large infrastructure, you could create incredibly lean insurance products that remain cheap and accessible, regardless of the size of what you’re insuring. We’ve already seen FinTech companies tackle this problem and they’ve made great headway already, but micro-payments can accelerate this growth and create spin-off industries in large numbers.

All of these innovations point to a future where every person can access the insurance they need to manage all the risks that they face in their lives. Blockchain technology can be what helps us get there. And that’s exciting.

The OriginStamp Solution

It would be remiss of us not to mention how we see OriginStamp fitting into this equation. We’ve been working on our product for a long time now and we are always fascinated to see how our clients integrate our technology into different industries to disrupt the status quo. Insurance is no different.

The main benefit that OriginStamp provides is to create immutable timestamps that verify that certain events have happened – creating a trustworthy audit trail protected by blockchain technology. This makes data tamper-proof which helps insurance companies to avoid fraud, while also making the entire process easier for the person buying the insurance.

For example, a customer could prove their ‘low-risk behavior’ to an insurance provider thanks to verifiable data that maintains its integrity throughout. A tamper-proof logbook could show a healthcare insurance provider that the person applying for a policy has completed various workouts, taken various medicine, and a range of other health-related outcomes. This information could then be used the lower the premium that needs to be paid – because the insurance company fully understands the risk profile of the applicant. This is a win-win for both sides and allows for really precise insurance policy personalization at scale.

If we apply that same principle to another vertical, you might imagine cybersecurity insurance providers requiring proof that servers were updated within an organization to keep infrastructure up to date. OriginStamp can be used to timestamp those updates in a way that is completely transparent and accurate. Once again, this removes the need for trust and nurtures a much more efficient relationship between the insurance provider and the claimant.

Those are just two examples of where OriginStamp technologies can play a role in insurance. But we are speaking to new clients every day and continue to be amazed by how widespread these applications can be. We never cease to be amazed by the creative implementations that are possible, and that’s what keeps us motivated to keep building.

If you are in the insurance industry and would like to explore what blockchain technology can do for you, then we’d love to hear from you. Get in touch today and let’s discuss just what might be possible. This could be the start of something really transformative, and we’d love to be involved.

Stay informed with the latest insights in Crypto, Blockchain, and Cyber-Security! Subscribe to our newsletter now to receive exclusive updates, expert analyses, and current developments directly to your inbox. Don't miss the opportunity to expand your knowledge and stay up-to-date.

Love what you're reading? Subscribe for top stories in Crypto, Blockchain, and Cyber-Security. Stay informed with exclusive updates.

Please note that the Content may have been generated with the Help of AI. The editorial content of OriginStamp AG does not constitute a recommendation for investment or purchase advice. In principle, an investment can also lead to a total loss. Therefore, please seek advice before making an investment decision.

Blockchain Revolutionizing Healthcare: 6 Practical Applications

Discover how blockchain technology is transforming healthcare with secure patient data, holistic health records, drug traceability, genomics data security, smart contracts, and research incentives.

Blockchain Technology for Tracking and Tracing in Supply Chain Management

Learn how blockchain technology can revolutionize supply chain management by providing a tamper-proof, accurate, and transparent system for tracking and tracing goods.

Importance of Security, Traceability, and Immutability at OriginStamp

Understand the significance of Security, Traceability, and Immutability at OriginStamp with blockchain technology. Learn how these features enhance document validation and data integrity.

Protect your documents

Your gateway to unforgeable data. Imprint the authenticity of your information with our blockchain timestamp