The Future of Retail: Digital Payments

Salomon Kisters

Jun 2, 2023This post may contain affiliate links. If you use these links to buy something we may earn a commission. Thanks!

The retail industry is constantly evolving and keeping up with the latest trends is crucial for success.

And one of the biggest changes we are seeing today is the shift toward digital payments. With the rise of e-commerce and mobile shopping, more and more consumers are opting for digital payment options over traditional ones.

In this blog post, we will explore the future of retail and how digital payments are transforming the way we shop.

The Rise of Contactless Payments

Contactless payments have been on the rise in recent years, thanks to the convenience and speed they offer to both customers and retailers. By simply tapping their card or mobile device on a payment terminal, customers can complete transactions in a matter of seconds, without needing to enter a PIN or sign a receipt.

In response to the COVID-19 pandemic, contactless payments have become even more popular, as consumers have become more conscious of hygiene and avoiding touchpoints. Many retailers have adopted contactless payments as their preferred payment method, and some have even opted to go completely cashless.

Looking ahead, it’s clear that contactless payments will continue to play a major role in the future of retail. As more and more consumers become comfortable with this payment method, retailers will need to ensure that they have the infrastructure in place to accept contactless payments and that their staff are trained to handle this technology.

The Impact of Mobile Wallets on In-Store Purchases

Digital payments have become a popular option for in-store purchases. Instead of using cash or card, customers can now make payments through their smartphones, contactless cards, or QR codes. This trend has rapidly grown in recent years, with many retailers adopting digital payment methods to cater to customer preferences.

One major advantage of digital payments is convenience. With just a few taps on their mobile devices, customers can make purchases without the need to carry cash or cards. This reduces the risk of losing money or falling victim to debit or credit card fraud. Additionally, digital payments allow for faster and more streamlined checkout experiences, which can translate to higher customer satisfaction rates and increased sales.

Digital payments have also become popular due to their safety and hygiene aspects. In-store purchases can often involve the exchange of physical currency and contact with payment terminals, which can increase the risk of spreading germs. Digital payments, on the other hand, allow for contactless transactions, providing a safer and more hygienic payment solution.

How Cryptocurrencies Are Reshaping E-Commerce

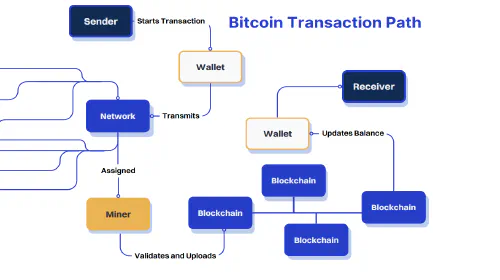

Cryptocurrencies, such as Bitcoin and Ethereum, are revolutionizing the way we think about digital payments. These decentralized forms of currency are based on blockchain technology, which enables secure transactions without the need for intermediaries like banks.

One of the big advantages of cryptocurrencies is that they can help eliminate fraud and reduce chargebacks. With traditional payment methods, chargebacks are a constant concern for retailers, as they can be expensive and time-consuming to resolve. Cryptocurrencies, on the other hand, use secure digital signatures and encryption to prevent fraudulent transactions.

Furthermore, cryptocurrencies have the potential to reduce transaction costs for retailers, as they eliminate the need for intermediaries and can offer lower processing fees. This can provide significant cost savings, especially for small businesses that are looking to reduce their overhead.

Overall, the rise of cryptocurrencies presents an exciting opportunity for retailers to streamline their payment processes, reduce costs, and enhance security. As adoption of these digital assets continues to grow, we can expect to see even more innovation in the world of retail payments.

Addressing Security Concerns with Digital Payment Methods

With the increasing popularity of digital payment methods, there are also growing concerns about the security of these platforms. Consumers worry about the possibility of their financial information being compromised, and businesses are concerned about the potential liability of storing customer data.

Fortunately, there are many measures being taken to address these security concerns. One solution is the use of encryption technology, which protects customers’ financial information during transactions and ensures that it cannot be accessed by unauthorized parties.

Another strategy is the implementation of multi-factor authentication, which requires users to provide multiple forms of identification before accessing their account or making a purchase. This helps to prevent unauthorized access to customer information and reduces the risk of fraudulent activity.

In addition, many digital payment platforms now use machine learning and artificial intelligence algorithms to detect suspicious behavior and prevent fraud before it occurs. These systems analyze user behavior and can quickly identify unusual activity that may indicate fraudulent behavior.

Overall, while security concerns with digital payment methods are understandable, there are many effective measures being taken to address these issues and ensure that consumers can feel confident in their use of these platforms.

The Role of AI and Personalization in the Payment Process

With the advent of digital payments, retailers have had to adapt to new advancements in technology to meet the changing needs of customers. One of the key ways that retailers can remain competitive in this landscape is by incorporating artificial intelligence (AI) and personalization capabilities into their payment processes.

AI can be used to improve the overall customer experience by analyzing customer data to provide personalized recommendations and offers. For example, a retailer could use AI algorithms to personalize a customer’s payment experience based on their individual preferences and buying habits. This could include offering customized promotions or providing suggestions for products that customers may be interested in purchasing.

Personalization also extends to the payment method itself, as customers increasingly demand a seamless and convenient payment experience. Retailers can use AI to streamline the payment process by offering fast and secure payment options, such as biometric authentication or digital wallets. By offering a personalized payment experience, retailers can not only improve customer satisfaction but also increase the likelihood of repeat business.

Overall, the adoption of AI and personalization in the payment process provides a significant opportunity for retailers to remain competitive in the digital age. By leveraging technology to provide a more personalized and streamlined payment experience, retailers can differentiate themselves from the competition and build better relationships with their customers.

Stay informed with the latest insights in Crypto, Blockchain, and Cyber-Security! Subscribe to our newsletter now to receive exclusive updates, expert analyses, and current developments directly to your inbox. Don't miss the opportunity to expand your knowledge and stay up-to-date.

Love what you're reading? Subscribe for top stories in Crypto, Blockchain, and Cyber-Security. Stay informed with exclusive updates.

Please note that the Content may have been generated with the Help of AI. The editorial content of OriginStamp AG does not constitute a recommendation for investment or purchase advice. In principle, an investment can also lead to a total loss. Therefore, please seek advice before making an investment decision.

How Much Does it Cost to Send USDT?

Learn all about the cost of sending USDT and the reasons behind the fee charged.

What Is DAI Coin and Why Is It Special?

Many stablecoins are pegged to a currency like USD, usually in a 1:1 ratio. An example is the DAI coin, which we are covering in this article.

How to Create a Bitcoin Blockchain Address: A Step-by-Step Guide

Discover the process of generating a Bitcoin blockchain address through our detailed step-by-step tutorial. Get started with cryptocurrency now!

Protect your documents

Your gateway to unforgeable data. Imprint the authenticity of your information with our blockchain timestamp