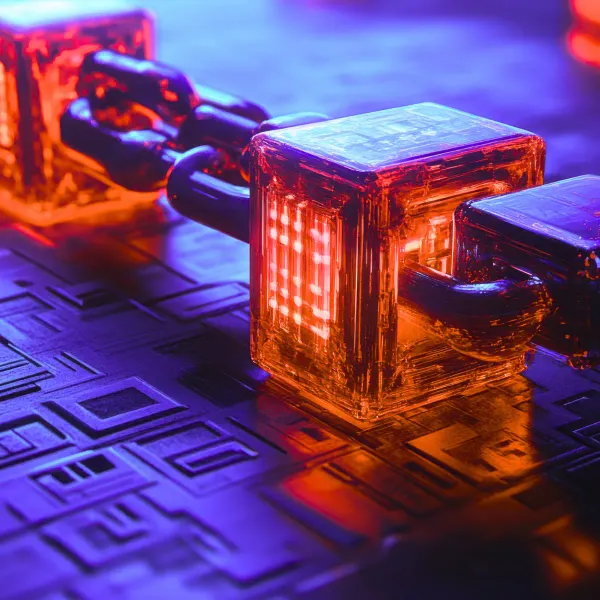

Rethinking Insurance: Data That Doesn't Flinch.

Blockchain timestamping ensures every policy, claim, and process step is documented with absolute integrity—externally verified, legally binding, and regulator-proof.

Why Insurance Processes Falter

Claims, assessments, and contracts are vulnerable to manipulation, system failures, and data gaps—driving up audit costs and killing trust.

What Insurers Demand Today

Immutable Claim Documents

Every claim must be clear, correct, and provable. Period.

Provable Chronologies

Every action must be provable—no room for interpretation.

Legally & Audit-Proof Archiving

Policies, contracts, and assessments built to last. Forever.

External Verification

Internal systems don't cut it. Regulators demand real proof.

Ironclad Compliance

Effortlessly meet FINMA, BaFin & EU requirements.

The Real Risk

Without independent validation, insurers lose clarity, trust, and—when disputes arise—control.

Manipulated Claims

Undocumented changes lead directly to disputes and costs.

Lack of External Verification

Internal systems are a single point of failure. Full stop.

Fraud Risks

Without tamper-proof evidence, the potential for fraud skyrockets.

Ambiguous Assessment Trails

Without a clear chronology, every audit is a ticking time bomb.

Sky-High Audit Costs

Manual audits are expensive, slow, and error-prone.

Weak Evidence

Without undeniable proof, insurers lose their leverage.

How Our Solution Delivers

External, neutral, and immutable: The ultimate foundation for modern insurance.

How It Works

A Unique Hash for Every Document

Every action gets an immutable digital identity.

Anchored on Bitcoin & Ethereum

Maximum evidentiary power through global blockchain networks.

Immutable History

All changes are documented, tamper-proof.

External Verification

Neutral, independent, and verifiable anytime, by anyone.

Use Cases

From claims to compliance, timestamping fortifies every link in the chain.

Claims Management

Claims Management

Claims, photos, expert reports—all archived with tamper-proof integrity.

Claims Management

Claims, photos, expert reports—all archived with tamper-proof integrity.

Underwriting

Underwriting

Risk data and assessments, documented with indisputable, immutable clarity.

Underwriting

Risk data and assessments, documented with indisputable, immutable clarity.

Policy & Contract Management

Policy & Contract Management

Every contract amendment is transparent, traceable, and provable.

Policy & Contract Management

Every contract amendment is transparent, traceable, and provable.

Your Advantages

More security, less overhead, undeniable proof.

Tamper-Proof Evidence

Every action gets a blockchain-anchored identity—perfect for audits, disputes, and compliance.

Regulatory Resilience

FINMA, BaFin, and other requirements are automatically supported.

API-first Integration

Seamlessly integrates with your existing claims, contract, risk, and document systems.

Automated Compliance

Generate externally verifiable audit trails in seconds, not hours.

Proof That Matters

IPBee is dedicated to protecting our clients' brand integrity across marketplaces, domains, and social media. Our partnership with OriginStamp allows us to create global, secure proof of all copyrights.

Jan F. TimmeCEO, IPBee

The Future of Insurance Integrity

Why tamper-proof documentation is the new standard, and how blockchain timestamping gives insurers the upper hand.

Insurance Processes That Don't Break

In 15 minutes, we'll show you how to make your claims, contract, and audit data completely tamper-proof with blockchain timestamping.